Fast Online Instant Approvals

500,000 Customers

No Prepayment Fees

Flexible payments

A quick & transparent process

We have

a simple online

application:

It takes just a few minutes to provide us with your information.

Using our secure application, you can e-sign your contract if pre-approved. Trust & security is our #1 priority.

Money can be directly deposited into your bank account as soon as the next business day.

Calculate Tour Rate

Things to know about our costs

Transparent and fair costs, with no hidden fees

Personal finance that fits you

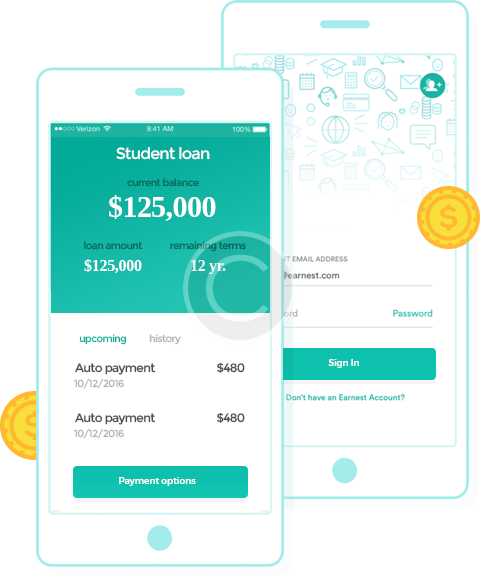

We've built a secure & personalized experience

- Checking your rates won’t affect your credit score

- Our rates are often lower than the banks

- We have simple online application

- No early repayment fees, no hidden charges

Personal loans for most purposes

Building a brighter financial future

98% of our customers left satisfied

You’re in good company

“I used Meredian to help me pay for travel expenses. The service was great – fast but still friendly. Fantastic and Painless Experience. Thank you.”

“Their application process was quick and simple. In a short time I had the funds I needed to complete some much needed improvements around the house.”

“These guys are always ready to help when you need it most. They helped cover school fees for my brother and I when I was a little low on cash.”

Resources that put you in control

Benefits to meet your needs

Checking your rates in 3 minutes!

Use our app to see your personalised loan rates

What is a personal installment loan?

In a nutshell, it’s easy funding for life’s expenses. You borrow an approved amount of money and pay it back over a set period of time. With fixed interest rates and scheduled payments, personal loans are designed to fit into your budget with a predictable repayment plan.

Getting a Loan is Easy

You can think of a personal loan as an installment loan. You can take out a loan for a certain number of months and then pay back the original amount plus interest in monthly installments. When you’ve made all your payments according to your signed agreement, your account will be finished. Of course, if the need arises for more money…

What is the difference between an unsecured load and a secured loan?

You may qualify for a lower rate and/or a higher loan amount if you are approved for a secured loan. Secured Loans A secured loan means you are pledging something of value as collateral to your loan to ensure that the loan will be repaid according to the loan’s terms and conditions. Assets such as cars can be used as…

Ready to get started?

Need more help?

Feel free to ask us about it!

Live help

Get an answer on the spot. We’re online 8am – 7pm Mon to Fri and 9am – 3pm on Sat and Sun.

See our FAQs

See answers to questions on how to use our services